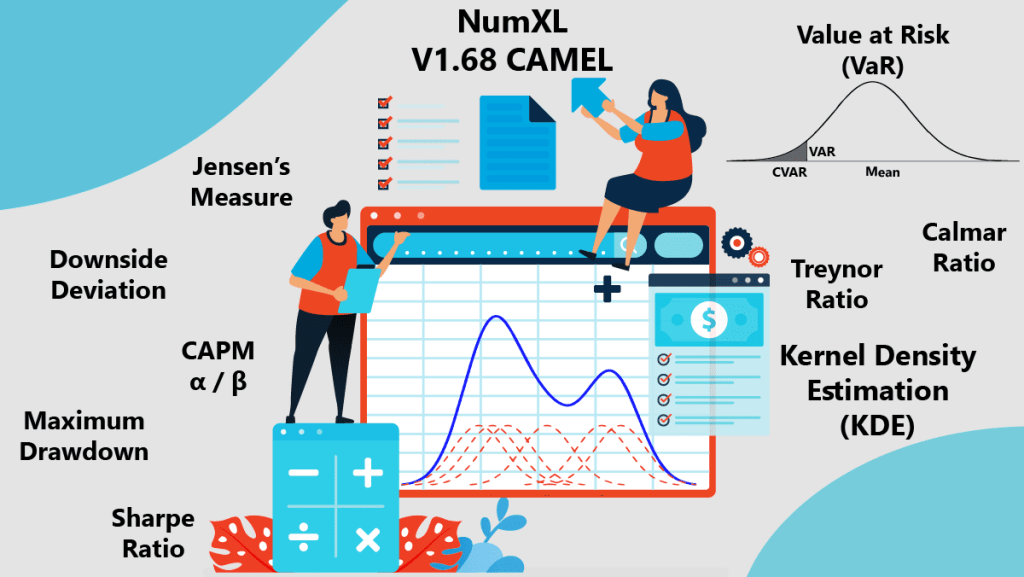

NumXL V1.68 CAMEL is Here!

We are excited to announce the release of NumXL version 1.68 (CAMEL). The new version includes support for portfolio risk -statistics and , enhanced support for Kernel Density Estimation (KDE) in Microsoft Excel.

You can instruct the KDE wizard to define domain-bounds for input variables, transform data, and calculate optimal bandwidth using 3 methods: Direct Plug-in (Sheather & Jones), unbiased cross-validation methods, and Silverman’s rule-of-thumb.

Furthermore, using the enhanced KDE function, you can calculate probability density, cumulative, and inverse cumulative functions of your distribution.

On the portfolio side, NumXL 1.68 implements 11 new risk metrics: CAGR, Sharpe Ratio, CAPM Beta, Jenssen’s Alpha, Treynor Ratio, Calamar Ratio, up/down market capture, maximum drawdown, value-at-risk (VaR), and conditional value-at-risk (CVaR).

NumXL supports the calculation of VaR and CVaR using different methods: historical, KDE-based, and theoretical distributions: Gaussian and lognormal.